What is a "rate lock period"?

What is a "rate lock period"?

A rate lock or a rate commitment is a lender's promise to hold or guarantee to you, a certain interest rate and a certain point-cost, for a specified period of time, while your mortgage loan application is processed. This prevents you from going through the whole loan approval process and at the end finding out the interest rate and/or points have gone up.

A rate lock period can vary in length, and longer ones almost always cost more. The longer you ask the lender to lock or guarantee the rate and points for you, the more the lender charges. With a rate lock, a lender will agree to "hold" your interest rate and points for a longer period, say 60 days, but in exchange the points and maybe the rate will be slightly higher than with a shorter rate lock period.

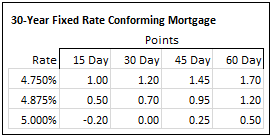

An excerpt from a typical lender's rate sheet might look something like this:

As you can see in the example, for the 5.000% interest rate, the point-cost increases from zero points for the 30-day rate lock, to one-quarter of a point for the 45-day rate lock. And for the 60-day rate lock the point-cost increases an additional one-quarter of a point, to one-half point.

The most commonly used rate lock periods are 30 or 45 days. A typical purchase escrow will take about 30 days, and 30-day rate locks are common for these purposes. 45-day rate locks are a good idea when there is some risk that the purchase escrow may drag on a bit because of unforeseen and foreseeable complications, like repairs needed to the house, or a probate or estate sale with many heirs. 30 and 45-day rate locks are also common for refinances, with 45-and 60-day locks more commonly used when the lenders, appraisers, and escrow companies become very busy, which usually happens when interest rates have taken a sudden dip or drop. When rates drop, there is often a flurry of new loan business that tends to slow or bog down the loan process for everyone.

Many lenders will allow you to later purchase additional days of rate lock, (which are usually due to unforeseen complications), and this is commonly done in 1 to 5-day increments, but the cost-per-day can be greater than the cost-per-day of the original rate lock. Therefore, it is usually best to consider your original rate lock choices carefully, with the aid of me, your professional mortgage loan specialist.

Borrowers can also choose to not lock their rate until farther into the loan approval process. In the mortgage industry this is called "floating". Typically home buyers don't want interest rate surprises, and want to know with certainty what their mortgage payment will be in the end, so I usually recommend that home purchasers lock in a rate as soon as possible after their purchase contract is set. Refinancers have a little more flexibility, because if rates start heading up dramatically, they can choose to not complete the loan, or delay completing the loan until rates settle down. If refinancers who are "floating" feel that rates might spike up, their loans can be locked on fairly short notice to keep from completely losing the low rates and points.

Shorter and cheaper rate locks of 7 to 15 days are also available, but it is usually not possible to complete a loan transaction in that short of a period of time, so their use is generally limited to those situations where the borrower has chosen to not initially lock their rate—to let their rate “float” in other words—AND where the loan is fully approved, in other words, where the appraisal and title work is all complete, and the final loan paperwork can be completed quickly. Longer rate lock periods of 90, 120 or 180 days are also available, although their use is fairly rare, because as you can probably guess, they are progressively more expensive than the shorter locks. Some long rate locks beyond 60 days actually require an upfront, non-refundable deposit. Locks less than 60 days don't require any upfront money from the borrower.

As your mortgage broker and mortgage specialist, I can help you to understand the process and the risks, and help you choose an appropriate length rate lock period. You can read more about when to lock your interest rate by clicking HERE. You can also read more about news affecting mortgage interest rates on my Daily Rate Lock Advisory by clicking HERE.

>HERE.